So you’ve been traveling to meet clients and running errands for your S Corp. And after all that hard work, don’t you deserve a reward? Something you’ve been eyeing for months—like maybe that new sexy pickup truck at the dealership!

You know you can write off your business trips, but beyond that, you’re lost. Should you register the vehicle in your own name? Set up your monthly payments through your business? Does your S Corp pay for your gas, insurance, and maintenance?

These are all questions worth figuring out. And we’ve got answers.

Before you rush to the dealership to sign on the dotted line, here’s what you need to know about writing off your car as an S Corp owner and maximizing your vehicle tax deduction using the QuickBooks Online (QBO) Mileage Tracker.

Step 1: Talk to your tax professional

There are two methods to claim vehicle deductions: standard mileage and actual expense. But which one is right for you?

Here are some things to consider:

- Will you lease or buy?

- On average, how many miles do you drive per year?

- Will the vehicle be registered in your name or the corporation’s name?

- How long do you plan to keep the vehicle?

Based on your answers, your tax professional will estimate your potential tax deductions and recommend your best option.

In this article, let’s assume your tax professional recommends the standard mileage deduction. What is the standard mileage rate? The IRS sets the standard mileage rate each year, which is 70 cents per mile for 2025. This rate includes allowances for expenses like wear and tear, maintenance, repairs, gas, and insurance.

For example, let’s say you drive 10,000 business miles in a tax year. Here’s how you would calculate your deduction for the year:

10,000 miles x $0.70 = $7,000

Step 2: Set up reimbursable expenses

To write off your S Corp mileage, your company should reimburse you for the business use of your personal car. The vehicle is registered under your name and you pay all expenses such as gas, repairs, and insurance from your personal account. The S Corp is claiming the reimbursement as a vehicle deduction, which reduces the taxable profit of the business.

You’re probably thinking, “Wait, the S Corp doesn’t pay taxes. I do!” That’s true, and the reduced taxable income passes through to you, the S Corp shareholder, who is then taxed individually.

And what’s exciting about this deduction (yes, tax deductions have an irresistible allure) is that the reimbursement isn’t reportable as taxable income to you or reported on your W-2. The caveat? You need to submit reimbursement requests to your business in a routine, timely fashion via an accountable plan. Accountable plan is just a fancy term for an expense reimbursement process- don’t worry we can help you set yours up.

Every month, you’ll submit expense reimbursements from your S Corp. The S Corp will then issue you reimbursement checks for your expenses.

You’ll need a mileage log to prove your expenses for your reimbursement request. This log needs to show the:

- Date

- Business purpose of the trip

- Number of miles driven

If this task seems daunting, that’s because it can be! But now, there’s an easier way to track your business miles.

Step 3: Add your vehicle to QuickBooks Online

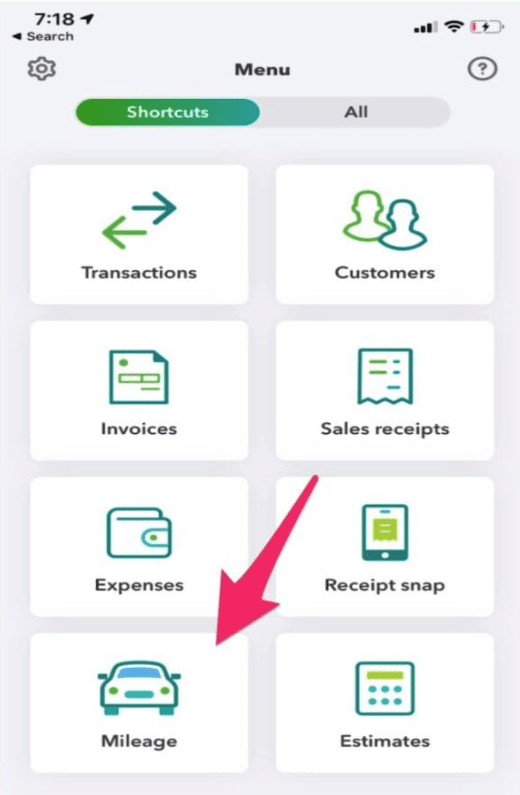

You can add your vehicle in Quickbooks Online browser or you can download the QuickBooks mobile app. The steps below are done using the mileage tracker.

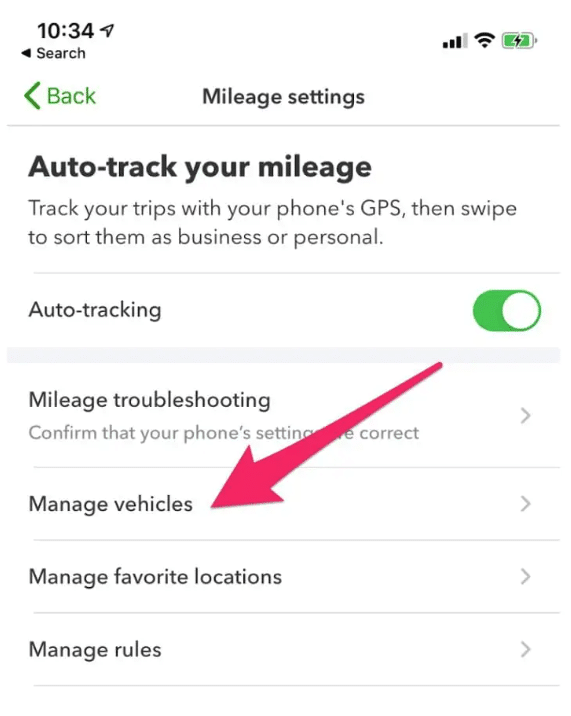

Sign in to your account and select Mileage. Set up Mileage to record information about your vehicle. To get started, select Manage vehicles on the app.

From here, you’ll do the following to set up your vehicle in the QuickBooks Online app:

- Enter the vehicle make, model, and year.

- Select whether you own or lease the vehicle.

- Choose vehicle type (car, van, motorbike).

- Set as your primary vehicle (or not).

- Enter vehicle cost.

- Enter the date the vehicle was bought.

- Enter the date it was placed in service.

- Odometer reading for January 1, 2020.

- You can add more vehicles using the same steps.

Step 4: Track your miles

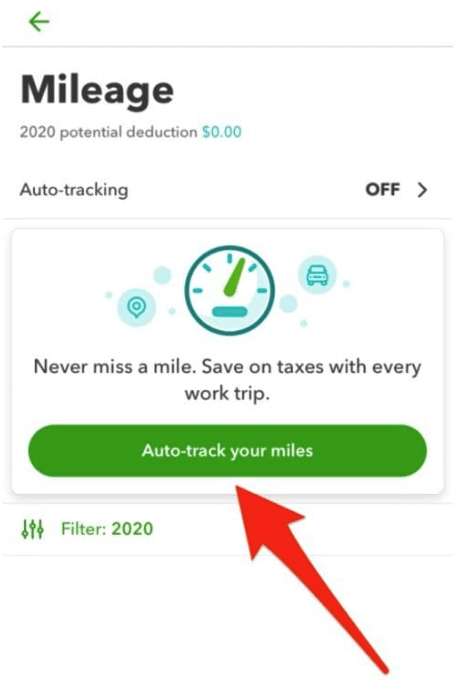

Using your smartphone, you can record your trips automatically using the Mileage Tracker from QuickBooks. You may be familiar with this system if you have been using QuickBooks Self-Employed. This feature is now part of all QuickBooks Online plans. All you have to do is:

1. Sign in to your account and select Mileage.

2. Enable GPS tracking to record trips automatically.

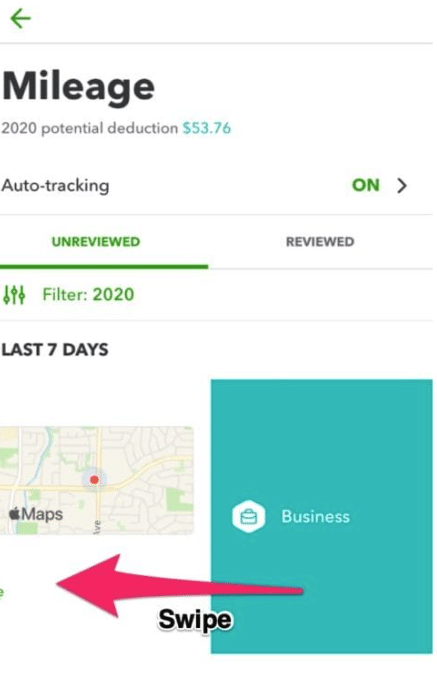

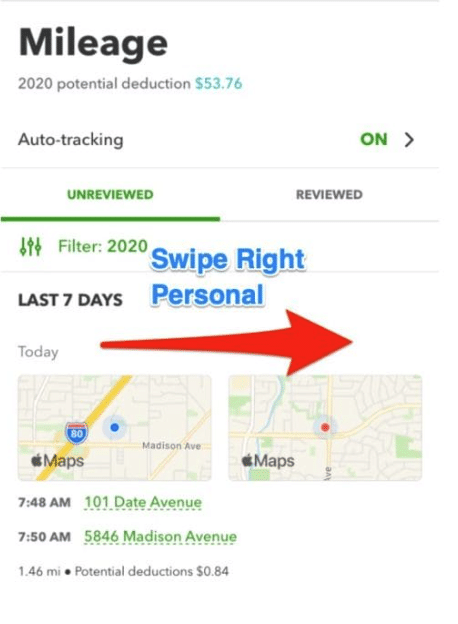

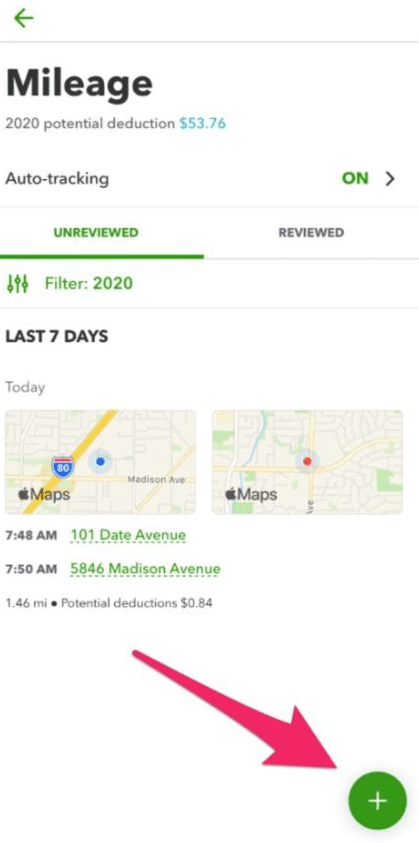

3. In the Unreviewed tab, categorize trips as “business” (swipe left) and then enter the business purpose.

4. Or, categorize trips as “personal” (swipe right).

If you don’t want your app to track your whereabouts all the time, you can hit the + button to add business miles manually.

Step 5: Review your trips

You can do this via the browser and add any trips that may be missing. Download a copy of the .CSV file as a backup for your records. To download a .CSV file of your mileage, go to Mileage, Options, Download trips.

Step 6: Reimburse the expenses

Save copies of your downloaded trips. This is essentially giving your employer a Mileage report in which you entered your business miles for reimbursement. You can do this every month.

Issue a check or transfer payments monthly to your personal account to reimburse your expenses. Code the expense as “mileage allowance expense” and write “To record mileage for (month)” in the description field.

And there you have it! A mileage log to capture all your vehicle’s tax deductions that will avoid any discussion with the IRS. The best news of all? Automating your mileage tracking with QuickBooks Online gives you even more time to gaze lovingly at your brand-new truck.

Raquel is an Accounting Manager at Collective. As a CPA, advanced QBO ProAdvisor and a former tax credit consultant for California Franchise Tax Board, she loves to help self-employed grow their business.