On your self-employed journey, there may be issues and roadblocks that affect the speed with which you scale your business. Understanding how to harness the strengths and weaknesses of your financial identity can help pinpoint the issues and illuminate what might be slowing you down.

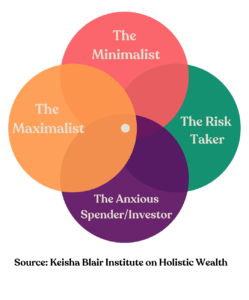

In the first and second articles in this series, I offered a primer on the Personal Financial Identities Framework that I developed, with information on each type and a quiz to reveal your financial identity. Here’s a quick diagram outlining the four personal financial identities:

For the Minimalist

Your mantra of simple living to its core is readily applicable to your business decisions, including automating and streamlining, how you interact with your clients and fine-tuning your core product offering.

With minimalism in business, you’ll want to develop a business mission that eliminates time-consuming detours and “shiny new object syndrome.” Figuring out which offerings yield the most profitable outcomes (in terms of time and money) will deliver the most benefit to you, and you’ll avoid getting bogged down with multiple offerings that are time-consuming and yield low returns.

If you analyze all of your services and products and realize that only 20% deliver 80% of your income, then it’s time to streamline even further.

Advantages of the Minimalist:

- Does not rely on debt to finance business

- Can scale faster with a “lean-start-up mentality”

- Less likely to succumb to “shiny new object syndrome”

Disadvantages of the Minimalist:

- May overlook some great business opportunities

- Tends to take on less measured risks

For the Maximalist

Your mantra of “Go big, or go home” and your larger than life perspective on opportunities can be beneficial in business. You tend to be fearless, energetic with bold business ideas and a passion for innovation.

However, your tendency to want all (and often the priciest) bells and whistles can result in a loss of income before you even launch or have an opportunity to scale. While you may want a stunning website and a home office worthy of Architecture Digest – that doesn’t necessarily translate into profitability.

This could not only lead to significant expenses (as well as debt) but also perfectionism and procrastination in launching and scaling your business, missing out on “first-mover advantage” that’s so critical in a rapidly changing world. One important tactic for the Maximalist is accountability (find an accountability partner) and a budget and track your expenses closely.

Advantage of the Maximalist: Fearless, and energetic with a wealth of business ideas.

Disadvantage of the Maximalist: Tendency to take on more risk, debt and succumb to shiny-object syndrome because of inner and outward expectations.

For the Risk-Taker

You’re always on the lookout for the next business deal or investment – you can’t wait to wrap this one up because you heard about the new start-up that has a trendy new product.

However, with this tendency, you may become over-leveraged or go into debt. Continue to monitor your debt and ensure you don’t become too financially overcommitted. Also, get an accountability partner (like the Minimalist), as you continue your quest for world domination.

Advantages of the Risk-Taker:

- Driven to learn new skills

- Highly empowered to break through self-imposed limits

- Highly creative

- Has a clear sense of desires and breaks free from being just average in business

Disadvantage of the Risk-Taker:

- Tendency to become over-leveraged (with business or investment loans) and take on more debt

For the Anxious Spender

Anxious Spenders can suffer from “analysis paralysis,” endless research and anxiety and worry about their money decisions. In order to overcome this problem, Anxious Spenders can give themselves a deadline or set limits when it comes to business decisions.

Another tactic is to find an accountability partner – the Risk-Taker may be a great partner for the Anxious Spender, due to their bold, courageous nature.

Advantages of the Anxious Spender:

- Tendency to avoid money or business risks or mistakes

- Tendency allows for taking the time to discover their full potential

Disadvantages of the Anxious Spender:

- May overlook some beneficial business and investment opportunities

- Tends to take on less measured risks

Regardless of your personal financial identity, you can Succeed as a Business-of-One

Once you know what your personal obstacles are, it’s much easier to figure out a quick and easy solution to solve them.

As our world continues to change, we’ll need to get more sophisticated and self-aware about our financial identity and spending and savings habits to be more successful with our money and businesses. After COVID-19, most people will be reassessing their priorities and self-knowledge will be key. Goodbye to these “one size fits all” money rules. Moving forward, tailored solutions that fit our personal financial identities will be key to success.

Take the free quiz, if you haven’t yet, and then take the Personal Financial Identities Online Course in order to understand your personal financial identity for better success.

Keisha Blair is the world’s foremost expert on holistic wealth; the award-winning, bestselling author of “Holistic Wealth: 32 Life Lessons To Help You Find Purpose, Prosperity and Happiness;” and founder of the Keisha Blair Institute on Holistic Wealth, which offers the Certified Holistic Wealth Consultant Program. Her current focus at the Institute includes providing a range of course offerings and tools for entrepreneurs and professionals. She has been featured in The New York Times, Forbes, Wall Street Journal, Harvard Business Review, MSN, Yahoo Finance, and many other publications. Her writing has appeared in the New York Observer, Swaay Media, and Thrive Global. Find out more at www.keishablair.com.