We’re thrilled to release the first edition of the Collective B1 Economic Report, a semi-annual look into how the economy is going for American Businesses-of-One. This first of its kind report, examines revenue trends, cost trends and near-term business expectations among the self-employed, providing a brand-new indicator of economic growth. The report’s data and survey are sourced from our members who operate solo businesses across industries and states.

As financial pundits debate whether the economy is on the brink of a recession or only in a brief slowdown, tech layoffs continue to dominate headlines. Yet despite this turbulence, employment levels remain strong and stocks demonstrate signs of recovery. In past economic downturns, budding entrepreneurs have launched Businesses-of-One and become successful ventures. So what are Businesses-of-One expecting in these uncertain times?

“While Businesses-of-One are experiencing many of the same challenges as larger companies in the US, unlike many larger businesses, most expect their companies to do better or the same as they had before the macro headwinds began,” said Collective CEO Hooman Radfar. “Many of our members made the leap to self-employment during prior downturns and, for them, it continues to be business as usual.”

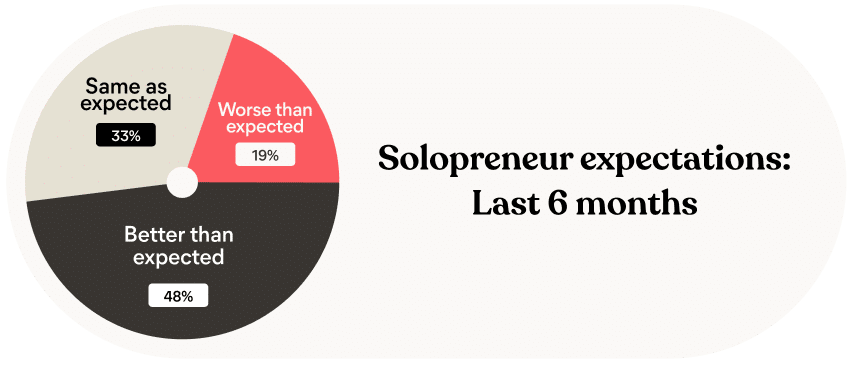

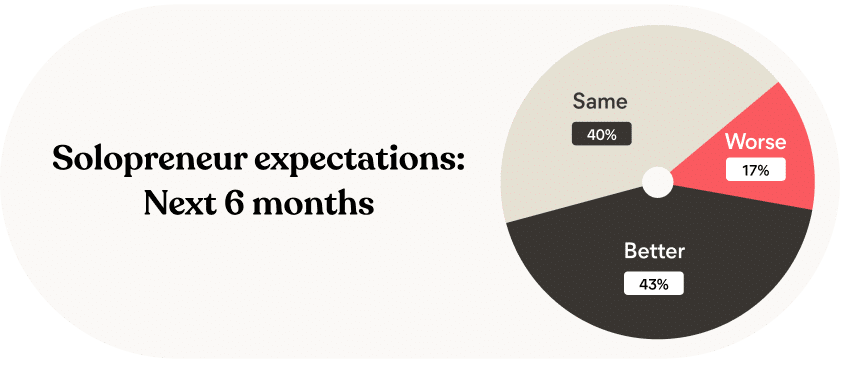

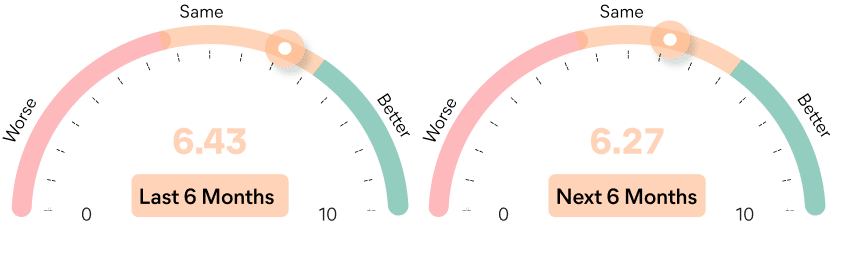

In fact, 81% reported that the last six months were the same or better for their businesses than they expected and 83% expect the next six months to be the same or better than the previous six months for their businesses. As one coach said, “My particular industry started to pick back up and more companies were open to hiring consultants over full-time employees.”

Although 2022 began brightly for Businesses-of-One, the second half of the year presented some headwinds. Net operating income, which indicates the profitability of a business, fell by 3% and expenses increased by 3.5%.

This is not abnormal for Businesses-of-One, who often increase their spending in the last quarter of the year to maximize their tax deductions or run catch-up payroll. Despite the slight net operating decrease, sentiment remained relatively unchanged period over period as solopreneurs maintained an optimistic outlook for 2023.

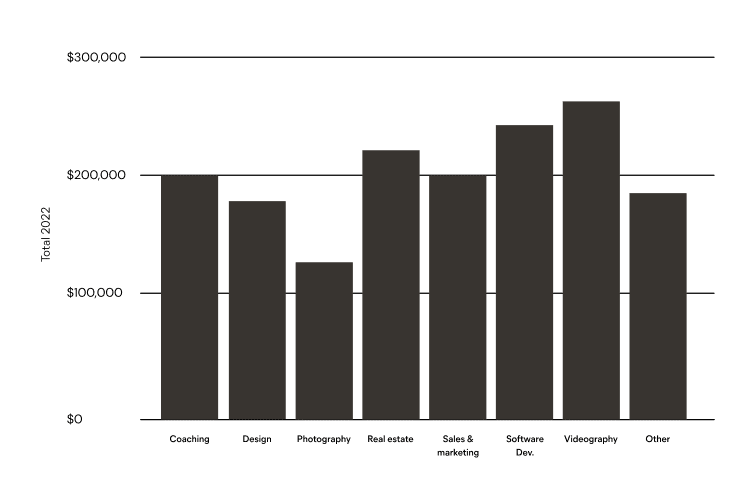

Businesses-of-One in sales and marketing saw the strongest growth among industries in H2 2022, with a 9.5% growth rate. The industries with the highest net operating income were videography, software development, and real estate.

There are currently an estimated 73.3 million freelancers in the US, and 8.2 million of them have joined since the pandemic began. As people become more open to flexible job functions, locations, and schedules, this part of the workforce will only continue to expand. By staying informed about Businesses-of-One’s economic status we can gain insight into the overall health of entrepreneurship.

We plan to publish the Collective B1 Economic Report on a semi-annual basis. The next B1 Economic Report will examine H1 2023 and will be available in H2 2023.

Methodology

The information in the Collective B1 Economic Report is based on aggregated net operating and expense income data derived from a sample of 700 Businesses-of-One from January 2022 through December 2022. In mid-January 2023, 63 of Collective’s members responded to the questions:

- Was the last six months better or worse for your business than expected?

- (better/same/worse)

- Do you expect the next six months to be better or worse than the last

- six months for your business? (better/same/worse