The Social Security wage base plays a role in how much you pay in Social Security taxes and as a result, self employment taxes, which are Social Security taxes and Medicare taxes combined. The Social Security wage base adjusts annually based on the national average wage index. For 2024, the wage base has risen significantly, increasing from $160,200 in 2023 to $168,600.

A higher wage base could result in a larger tax bill, making the tax benefits of forming an S Corp more substantial.

What Is the Social Security Wage Base?

First, let’s talk about Social Security taxes, which are officially known as Old-Age, Survivors, and Disability Insurance (OASDI) taxes. These taxes are processed by the Social Security Administration (SSA). Most filers with income pay these taxes, which are 12.4% and split between employers and employees, each paying 6.2%. If you’re self-employed, then you’ll pay the whole 12.4% yourself.

The Social Security wage base is the maximum amount of wages subject to OASDI taxes. In other words, there’s a limit to the amount of income that’s subject to 12.4% tax. Any income after that limit isn’t taxable for Social Security.

For example, imagine a taxpayer earns $100,000 per calendar year. They would pay $6,200 in OASDI taxes that tax year, and their small business owner employer would pay the same amount on their behalf. If that person earned $200,000 annually, they’d only pay OASDI taxes on their first $168,600 in earnings. The amount over the limit would not be taxed for Social Security.

As both an employee and employer, self-employed people pay both halves of the tax. This means they pay 12.4% for OASDI taxes in addition to income and other business taxes.

History of the Social Security Wage Base

The Social Security wage base adjusts regularly based on the national average wage index. It’s a measure of approximate average earnings in the United States. Typically, wages rise every year, leading to a rise in the Social Security wage base.

The first Social Security wage base was established in 1937, where it sat at $3,000 per year. Tax law first increased it in 1951 to $3,600 for tax purposes. Then, it rose every three to six years until 1972, when it started to adjust annually.

The wage base has risen dramatically in recent years. It was $137,700 in 2020 and has increased by over $30,000 in the years since.

How an S Corp Helps You Save Money

Social Security Taxes for Sole Proprietors and LLCs

A business entity that isn’t an S Corp, like a single-member limited liability company (LLC) or sole proprietorship, pays Social Security and Medicare taxes on all of its profit. Medicare taxes don’t have a wage limit so all self-employment income is subject to Medicare taxes.

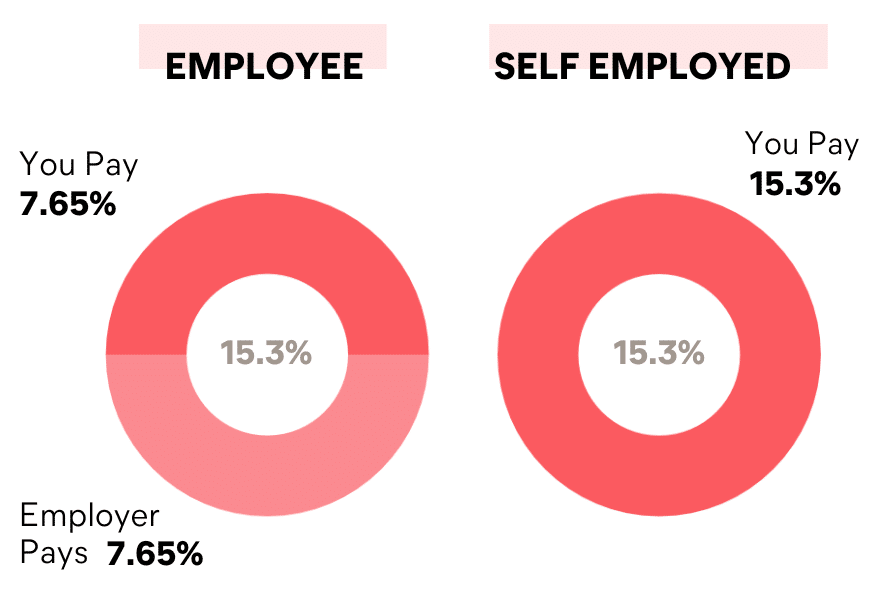

Typically, employers and employees pay 7.65% each in these tax payments. As both employee and employer, sole proprietors and single-member LLC owners pay the full 15.3% in self-employment taxes, which is made up of 12.4% for OASDI and 2.9% in Medicare taxes.

Social Security Taxes for S Corps

S Corps help business owners save money in a few key ways. When it comes to Social Security taxes, the savings come from taking company profits as distributions rather than a wage. Under an S Corp, the owner can split up their income into wages and distributions of business profit.

S corp shareholder distributions are earnings paid out as dividends. The internal revenue service (IRS) allows S corps to avoid double taxation. The functionality of an S corp is also in its tax rate – S corps don’t pay any income taxes at the corporate level. They’re pass-through entities, so owners report business income and losses on their personal tax returns.

Owners must pay themselves a wage that meets the IRS’s “reasonable compensation” (meaning reasonable salary) standard and wages are subject to Social Security and Medicare taxes (i.e. self-employment tax).

In a traditional employee-employer relationship, half the Social Security and Medicare tax is paid by the employee and half is paid by the employer. The employer’s portion is considered a cost of running the business.

This is still true in an S Corp structure where the owner is hired as an employee even though the employee and the employer are the same person (it’s meta, we know). This means the business owner can deduct the employer-paid portion of these taxes (half of the Social Security and Medicare tax paid) as a business expense. That reduces the amount of income they must report from their company on their personal taxes and their income tax liability.

The remaining business profit isn’t automatically subject to Social Security and Medicare taxes- only your owner remuneration is. You can then take any of your additional earnings as a distribution of business profit. Distributions are not employee wages, meaning they aren’t subject to payroll taxes like the federal unemployment tax (FUTA). This lets you avoid the 15.3% Medicare and Social Security tax (FICA). You still have to pay state and federal income taxes, but avoiding 15.3% in taxes is a significant amount of savings.

The only caveat is that your future Social Security benefits are based on your lifetime wages, so taking distributions will slightly reduce your future Social Security income. However, the immediate savings is more than likely to be worth that future decrease in benefits.

Higher Wage Base Means More Savings from S Corps

The ongoing increase in the wage base means that the savings you get from forming an S Corp have only increased. Given that the wage base only goes up, generally, your savings would get bigger every year.

Imagine you’re self-employed and running a successful small business full-time. Each year, you earn about $155,000 in profit.

In 2022, $147,000 of those earnings would be taxed for Social Security, meaning you’d pay $18,228 in Social Security tax. The full $155,000 would be subject to Medicare taxes, which would cost $4,495 and make your total tax burden $22,273 before income taxes.

In fiscal year 2024, the entire $155,000 you earn is subject to both Social Security and Medicare taxes. In all, you’d pay $23,715. That’s $1,442 in additional tax than what you’d have paid two years ago due to the increase in the wage base.

If you formed an S Corp, you might decide to pay yourself a salary of $80,000. That means taking the remaining $75,000 as a distribution.

You’d pay Social Security and Medicare taxes on the $80,000 salary, meaning you’d owe $12,240. You’d only pay income taxes on the $75,000 distribution. That means the S Corporation would save you $10,033 in payroll taxes during 2022 and $11,475 in 2024.

As you can see, generally, your savings from forming an S Corp would increase yearly with the Social Security wage base

Final Word

S Corps let self-employed people and business owners mitigate their tax liability by taking a portion of their earnings as distributions rather than wages. As the Social Security wage base increases, the potential savings from S Corp will only increase, making it a good idea to form one now.

Note: This article is for educational purposes only and refers to tax savings in general. Tax savings with an S Corp is based on your personal circumstance and Collective does not guarantee any tax savings with an S Corp structure.

TJ Porter is a freelance writer based in Boston, Massachusetts. He began covering finance while earning a degree in business at Northeastern University in Boston, Massachusetts and enjoys writing about credit, investing, real estate topics. When he’s not writing, TJ enjoys cooking, sports, and games of the video and board varieties. You can contact him at find more of his work at TJPorterWriting.com