In the first article in this series, we discussed why it’s important to embrace your own financial identity as an entrepreneur in order to be successful. Now, I’m going to offer a primer on the Financial Identities Framework I developed through the Certified Holistic Wealth TM Consultant Program and offered through the Keisha Blair Institute on Holistic Wealth.

After my husband died, I realized that I had only partially embraced my own financial identity. I am a Risk-Taker and he was a Minimalist. In any partnership (whether business or personal) it helps to understand your money motivations as well as your partners’.

Fully embracing your personal financial identity allows for self-awareness, self-advocacy and self-preservation. Understanding your partner’s financial identity helps with negotiation, accountability and keeping each other on track. It’s a win-win.

After my book was published, readers were coming forward to ask me what the financial identities were because they wanted to delve deeper and identify their personal financial identities. And many of these readers were business owners – primarily solopreneurs interested in learning more so they could apply these lessons in their business endeavors.

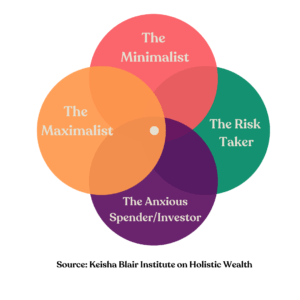

The Financial Identities Framework has four main criteria:

- Overall Debt Tolerance: Level of appetite in taking on debt when assessing financial decisions.

- Risk profile: Level of appetite in taking on additional risk in assessing financial decisions.

- Expectations of others: Willingness to yield to the expectations of others, like spending money to go out with friends.

- Inner expectations: The expectations we place on ourselves, like keeping our new years’ financial resolutions.

The most successful, wealthiest, happiest and most productive people aren’t those from a particular financial identity, but rather those who have figured out how to harness the strengths of their financial identity, counteract the weaknesses and build holistically wealthy lives.

As an entrepreneur, knowledge and wisdom gained from the Financial Identities Framework, can help you make better financial decisions, understand your money motivations, embrace your financial strengths, use your time more productively and suffer less stress.

Here’s a quick summary of the four financial identities.

KEISHA BLAIR’S FINANCIAL IDENTITIES FRAMEWORK

The Minimalist

“Simple Living/Keep It Simple”

The minimalist satisfies inner expectations and doesn’t yield to the expectations of others, with either their spending or investing habits. You’re a frugal person and astute with tracking your spending and budgeting. The minimalist doesn’t take on debt and, if they do, it’s minimal and paid back in full as soon as possible.

Signs that you’re a minimalist:

- Your mantra in life is simple living and you prefer simplicity in everything.

- You don’t feel like you need to follow the crowd with your spending or investment habits.

- You’re willing to take on only minimal risk on consumer spending because your mantra is simple living.

When I think about a prominent Minimalist – Warren Buffet comes to mind. With a net worth of over $90 billion, his debt and investment principles are sound.

One of his principles is “don’t ever get into debt unless you’ll profit from it”. He lives in the same house he bought in 1958 for $31,500, and drives cars that were damaged by hail.

Warren Buffet’s “20-Slot” rule of financial investing advocates for simplifying your life through a highly focused approach to investing. The 20 slots represent all the investments you can make in a lifetime, which requires directing your energy to fewer tasks.

The Maximalist

“The Lavish Spender/Go large or Go home”

With both spending and investment habits, the maximalist’s motivation is outward indicators of wealth (like real estate, beauty or fashion).

Signs that you’re a maximalist:

- You’re the life of the party and you love making others happy – even if it means going over budget to do it (maybe a lot over budget sometimes?).

- You like the best things or the most lavish things in life (like designer shoes), you drive an expensive car and your home is Architecture Digest-worthy.

- Your Instagram feed is the envy of your town and your vacations are lavish.

When I think of Maximalists, Kim and Cloe Kardashian, and Kylie Jenner come to mind, who are all entrepreneurs and television stars of the hit series “Keeping Up With The Kardashians”. Other fictional TV characters that have maximlist qualities , albeit in a more extreme form, are Carrie Bradshaw, a freelancer, from “Sex and the City” and Rebecca Bloomwood from “Confessions of a Shopaholic”.

Take the quiz to find out your financial identity!

The Risk Taker

“Always on the Lookout for the Next Deal”

Risk-Takers take on more risk than average in an effort to accumulate more assets and investments, and to further certain financial, entrepreneurial and lifestyle goals that they’ve outlined.

Signs that you’re a risk-taker:

- You’re meticulous at planning for big money milestones such as starting a business or retirement.

- Your risk-taking isn’t fueled by self-indulgence but is goal-driven.

- You prefer to hit certain money milestones by a certain age or life stage.

When I think of prominent risk takers, Oprah Winfrey comes to mind. With a net worth of $2.6 billion Oprah Winfrey grew up poor and, by taking risks, transformed her famous talk show “The Oprah Winfrey Show” into a lifestyle brand, and is a self-made billionaire.

Thanks to Collective, I don’t have to worry about bookkeeping, taxes and other government related tasks and can focus 100% on my work. If you’re self-employed and need help with tax, bookkeeping and ongoing support, all-in-one place, you’ll love Collective!

Arjun Dev Arora

Strategy, Venture, Technology

The Anxious Spender/Investor

“Money equals Stress/Anxiety”

The Anxious spender/investor is as the name suggests: a conservative, risk-averse personality but with the added layer of being worried about money and a tendency to become anxious about making money decisions.

Signs you’re an anxious spender/investor:

- You’re always worried about ending up poor or not having enough money for a rainy day

- You question, worry and feel inadequate about your money decisions.

- Your number one worry and concern in life is money-related

The fictional character of Earnest “Earn” Marks from the FX series Atlanta portrays this well. Other prominent TV stars who are risk-takers include investors on Shark Tank, including Mark Cuban, Barbara Corcoran and Lori Greiner or in the case of Canada, any of the TV stars on CBC’s Dragons Den, including Arlene Dickinson, Michele Romanow and Manjit Minhas.

Still not sure which financial identity is yours? Take this quick quiz to find out.

Now that you know your financial identity, in the final article in this series, we outline how to hack your Business-of-One by embracing your personal financial identity. We also highlight stumbling blocks with each financial identity and outline some productivity hacks to solve these issues.

Keisha Blair is the world’s foremost expert on holistic wealth; the award-winning, bestselling author of “Holistic Wealth: 32 Life Lessons To Help You Find Purpose, Prosperity and Happiness;” and founder of the Keisha Blair Institute on Holistic Wealth, which offers the Certified Holistic Wealth Consultant Program. Her current focus at the Institute includes providing a range of course offerings and tools for entrepreneurs and professionals. She has been featured in The New York Times, Forbes, Wall Street Journal, Harvard Business Review, MSN, Yahoo Finance, and many other publications. Her writing has appeared in the New York Observer, Swaay Media, and Thrive Global. Find out more at www.keishablair.com.