Knowing your business’s net income is vital to understanding the financial health of your business — and it’s simply a matter of subtracting expenses from revenue.

This number is a quick measure of the viability of a business, and it overcomes overly optimistic reporting on numbers like revenue and customer growth by factoring in the other side of the equation: costs and expenses. Here’s how to calculate net income for your business, including a simple net income formula you can plug your own numbers into.

What is net income?

In business, net income reflects your revenue minus your costs. Sometimes called net profit or net earnings, it’s the most important number to show the health of your business’s finances.

Why?

It’s easy to get excited about high revenue — the money you bring in from selling goods or services. But if you have to spend a lot of money to produce products or market your services, your business might not benefit much from that revenue.

If I had to run a $600 ad to obtain a $500 freelance job, for example, claiming six-figure revenues would be meaningless. Or, if I paid subcontractors $450 for that $500 worth of work, I’d have a hard time getting by.

So net income shows you what you actually earn when it’s all said and done.

For a Business-of-One, this is usually your take-home pay (before taxes). For a larger business, this is the best indicator of how much money a company is earning. That’s why it’s also called “net profit” or “net earnings.”

Is profit the same as net income?

“Profit” can mean a lot of things in business, depending on your calculations. That’s why financial reports get specific with a universal term like “net income,” because it’s calculated the same way in every company. One important distinction you need to know is “gross profit” versus “net profit.”.

Gross profit is your revenue minus cost of sales (also called cost of goods sold). Cost of sales only includes direct costs related to a product or service you sell. The difference between your revenue for an item and your gross profit is called a profit margin, usually expressed as a percentage.

Revenue – Cost of Sales = Gross Profit

Gross profit doesn’t include other costs in your business, like office space and supplies, software, employees who don’t work directly on the project, or marketing costs — even if any of these contributed to you landing the work.

As a self-employed entrepreneur, for example, your gross profit might include:

- The amount you’re paid to write an article minus the cost of an SEO report you ran for the piece.

- The total you’re paid for a coaching session minus the cost of a workbook you give to clients.

- The retail price of your handmade jewelry minus the cost of the materials you use to make the piece.

- The amount you’re paid for a social media campaign you manage minus the fees you pay to a designer and writer you subcontract to create the content.

Net profit includes your gross profit minus all expenses, including the overhead and marketing costs I mentioned above, and interest on any debts you’re repaying.

Some examples for self-employed entrepreneurs might include:

- The amount you earn in a month writing articles, minus the monthly subscription costs of SEO tools and Google Workspace, minus the membership fee for a coworking space.

- The total you earn in a quarter from coaching clients, minus the printing cost of your most recent run of workbooks, minus the amount you paid into Instagram ads.

- Your total jewelry sales for the year, minus the cost of materials, minus the fees you paid for booths at art shows and farmers markets, and your transportation costs.

- The amount you earn this year from social media management, minus all wages paid to subcontractors, minus subscription fees for your social media tools, the cost of your new laptop and the salary and benefits for your full-time virtual assistant.

Can you see how net profit better reflects the health of your business overall compared with gross profit? Gross profit can help you choose more affordable ways to outsource labor for your jobs, but net profit lets you know whether it makes real financial sense to hire your first full-time employee.

Net income vs. net operating income

To drill down even further, you can calculate net operating income, which includes a few more financial details and gives an even more complete picture of your business’s finances.

Net operating income is sometimes referred to as earnings before interest, taxes, depreciation and amortization (known as EBITDA among accounting types). In net income, you subtract the costs of interest paid on debts, taxes, depreciation of the value of physical assets you own and amortization of long-term expenses. In EBITDA, you add those back in.

Net Income + Interest + Taxes + Depreciation + Amortization = Net Operating Income

The EBITDA formula is mostly popular with investors and lenders to measure the health of a business. It’s not what you should use to make financial decisions around your products or services, but it’s an important number to know before you head to a bank or investor to ask for money.

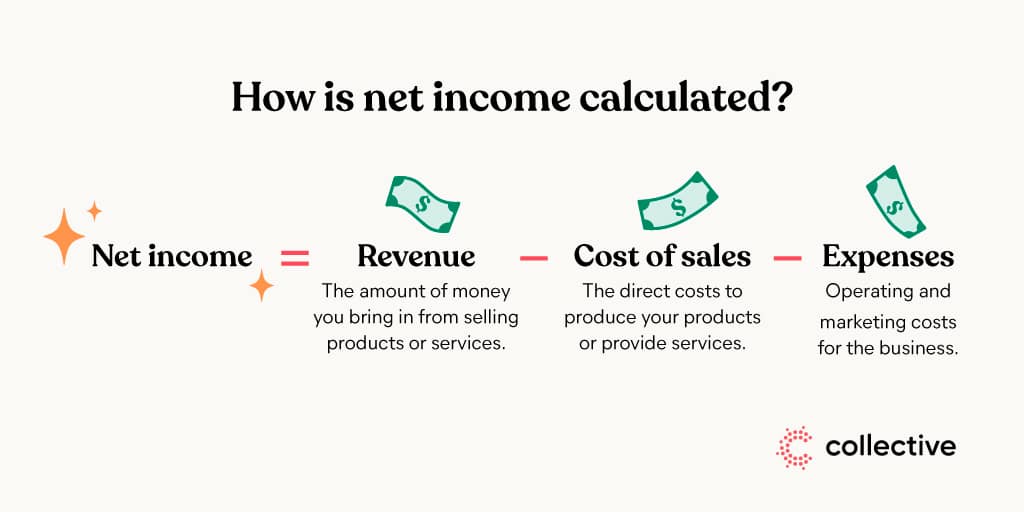

How is net income calculated?

The formula to calculate net income is:

Revenue – Cost of sales – Expenses = Net income

Where:

- Revenue: The amount of money you bring in from selling products or services.

- Cost of sales: The direct costs to produce your products or provide services.

- Expenses: Operating and marketing costs for the business.

Pro tip: You should be able to pull each of these numbers from whatever accounting software you use.

Let’s look at an example.

Say you run a business out of your home as a marketing consultant with clients paying you a total of $15,000 per month. Here’s how to figure out your net income for the year:

- Revenue: $180,000

- Cost of sales: $54,000 for subcontractors

- Rent: $7,500 (a portion of your apartment rental)

- Utilities: $1,500 (a portion of your home utilities)

- Contractors: $12,000 for a virtual assistant

- Advertising: $2,000

- Interest on debts: $0

$180,000 (Revenue) – $54,000 (Cost of Sales) – $77,000 (Total Expenses) = $103,000 (Net Income)

What is the net operating income formula?

The formula to calculate net operating income is:

Gross profit – Operating expenses – Depreciation expense – Amortization expense = Net operating income

How to calculate net income from gross income

“Gross income” is a term used with taxes, usually for individuals rather than businesses. It has a similar meaning to revenue: the money you earn before subtracting expenses and taxes.

It’s not the same thing as gross profit, which includes cost of sales and is usually used by businesses rather than individuals.

If you run a Business-of-One, your gross income might be the same as your business’s net income — your take-home pay after business expenses are taken care of. That’ll depend on how you structure the business and how you pay yourself.

How do you calculate total income?

Your business’s total income is the sum of gross income from all sources before subtracting expenses.

For example, if you provide consulting, sell online courses and do some copywriting, your total income for the year would be your earnings from all three, minus cost of sales for all three.

To calculate your expected total income based on hourly, weekly or monthly income, assuming a 40-hour workweek and 50 working weeks each year:

- Hourly: Multiply your hourly rate by 2,000.

- Weekly: Multiply your weekly income by 50.

- Monthly: Multiply your monthly income by 12.

You can also apply the formulas backward to set hourly rates or monthly retainers that help you reach an annual income target.

TL;DR

Net income is the key number to know if you want to understand where your business stands financially.

This number gives you insight into the health of the business’s finances that goes beyond flashy numbers like revenue or new customers. It accounts for the money you spend to do business, as well, to make sure you’re running a viable business.

To find net income, you just need to know two basic things about your business: how much you earn and how much you spend. Keep consistent records of those, and you’ll be on track to making sound decisions to maintain and grow the business for years to come.