Starting an LLC in Florida FAQs

Why Start an LLC in Florida?

If you’re in Florida, or planning to move your business to Florida, there are plenty of great reasons for starting an LLC in Florida. Florida has a low tax burden, being one of nine states in the U.S. that don’t have a personal income tax, making it an attractive state for pass-through entities such as LLCs and S corporations. And while processing times are never guaranteed, the standard processing time to form an LLC in Florida is six to eight business days, which is relatively fast compared to other states.

(image source: https://en.wikipedia.org/wiki/Seal_of_Florida

A Florida Limited Liability Company (LLC) is a type of private limited company in the United States, which is any type of business entity in private ownership. This means the company is owned by its founders and management and is therefore not beholden to shareholders.

So what are the benefits of starting an LLC in Florida? Compared to other business structures, LLCs have a relatively simple, flexible, low-cost structure that offers tax benefits and personal liability protection. See our ultimate guide for How to Start an LLC for a full breakdown of the advantages of LLCs and how they compare to other business structures.

So if you’ve ever wanted to know how to create an LLC in Florida, this simple guide for how to start an LLC in Florida shares all the important steps, requirements, state fees and costs you’ll need during the LLC formation process.

What are the Steps to Starting an LLC in Florida?

Forming an LLC in FL is a very straightforward process. There are 10 simple steps for how to get an LLC in Florida:

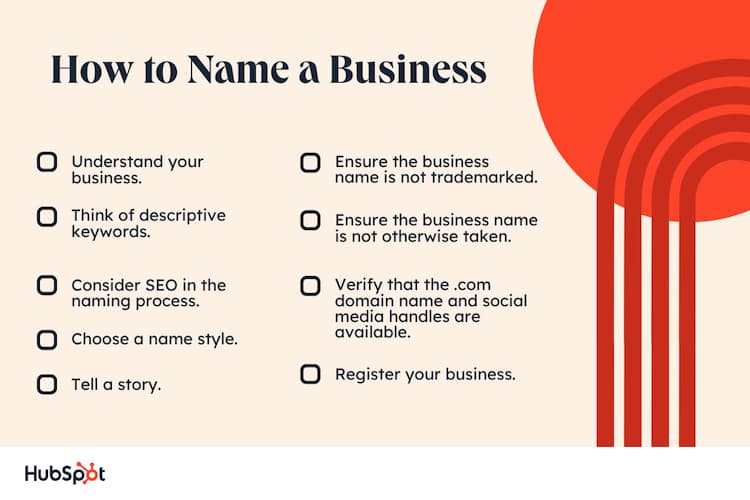

Step 1: Name Your Florida LLC

The first step to creating an LLC in Florida is to choose a name that is distinct, memorable, and, most importantly, available, and one that adheres to Florida naming rules. Your LLC’s name cannot have the same name as existing business entities in Florida. Search the Florida Division of Corporations’ entity name database to ensure that your chosen name is not already in use.

(image source: https://blog.hubspot.com/sales/business-name-ideas)

If your name is available, you can mail a letter specifying the name to be reserved and the name and address of the applicant to the Florida Secretary of State. Include the $25 filing fee. This reserves your name for 120 days.

Once you’ve established that your name is available, there are a few naming requirements to start an LLC in Florida. Review our guide to naming an LLC in Florida to ensure that it meets all of the state’s requirements.

Step 2: Designate a Registered Agent

If you want to form an LLC in Florida, you must choose a Registered Agent in Florida. An owner or an employee may serve as the Registered Agent for LLCs in Florida. To qualify as a Registered Agent in Florida, the individual must be over the age of 18, have a physical address in Florida that serves as the registered office, and must be on-site at the registered office and available to accept documents during regular business hours. This address can be the same as your business’s address.

You may also choose to employ a Registered Agent service in Florida, which will have additional fees. A Registered Agent service provides a physical address in Florida if none of the LLC owners or members have a physical Florida address. The average cost of using Registered Agent services in Florida is around $100, but can be as little as $49 per year and as much as $399 per year.

Step 3: File Articles of Organization

The next step to setting up an LLC in FL is to submit official formation documents, also known as Articles of Organization. In submitting your Articles of Organization, you will need to provide: your LLC name and principal business address, name and address of your registered agent (PO Box will not be accepted), names and addresses of all LLC members, name and address of the manager (if there is one), the function of your LLC, your LLC’s intended duration, and management structure.

The person forming the LLC and the Registered Agent must sign the Articles of Organization.

There is a $125 filing fee for domestic LLCs. If it’s accepted, you’ll receive a certificate of formal registration. See our Articles of Organization LLC Template to make sure you don’t miss anything.

Step 4: Create an Operating Agreement

While Florida doesn’t mandate the creation of an Operating Agreement, it is still a highly valuable practice if you want to set up an LLC in Florida. An Operating Agreement is a written document that outlines and ensures that all members understand and agree to their designated rights and responsibilities. See our LLC Operating Agreement Template to make sure you’re including all the essentials. An attorney should be consulted for more complex operations.

(image source: https://www.floridataxlawyers.com/the-benefits-of-llc-in-florida-for-small-business-owners)

Step 5: Receive a Certificate From the State

The next step in registering an LLC in Florida is receiving the certificate of formation. After an LLC’s formation documents have been filed and approved, the Florida Department of State will send you a certificate that formally confirms the existence of your LLC. The state will mail this certificate to the Florida mailing address you provided. This certificate will enable the LLC to get an Employer Identification Number (EIN), business licenses, and open a business bank account.

Step 6: Get an Employer Identification Number

The next step to starting an LLC in Florida is getting your tax ID number. The Internal Revenue Service (IRS) will assign you an Employer Identification Number (EIN) in order to identify your LLC for taxes. An EIN, sometimes referred to as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN), is nine digits and enables an LLC to file and manage taxes at the state and federal level, open a business bank account, and hire employees. You can obtain an EIN for free via the IRS online portal.

Step 7: Get a Florida Business License

The next step for how to register an LLC in Florida may involve additional licensing. Depending on the nature of your LLC, you may need to apply for a Florida business license. Check the U.S. Small Business Administration to see if your business activity is listed and requires a license, then contact the issuing agency for further details.

Step 8: Open a Florida Bank Account

If you want to register your LLC in Florida, you’ll need to link it to a bank account next. LLCs in Florida are required to have a bank account in Florida. You will need to provide the bank with your EIN and Articles of Organization in order to open a new business account in Florida. Remember, one of the main advantages of an LLC is protecting the business owners’ personal assets from business debts and lawsuits, so make sure that you’re always keeping business resources separate from your personal resources.

Step 9: Comply With Employer Obligations

Starting an LLC in Florida also requires complying with certain employer obligations. If your Florida LLC has employees, you must: purchase workers’ compensation insurance as soon as the fourth person is hired, pay unemployment taxes, and report new employee hires or rehires within 20 days to the Florida Department of Revenue.

Step 10: File a Statement of Information Annually

Now that you know how to apply for an LLC in Florida, you’ll need to ensure your LLC’s paperwork stays current. Once your LLC has been formed, file a statement of information every year as early as January 1st, but no later than 11:59 p.m. on May 1st. You can file online and there is a $138.75 filing fee.

Failure to file an annual report on time will result in a $400 fine. You will need to provide the 6- or 12-digit document number that was assigned to your entity when the business entity was filed or registered with the Division of Corporations. You can look up your document number via the Florida Division of Corporations entity name search.

How much does an LLC cost in Florida?

How much is an LLC in Florida altogether? The cost to start an LLC in Florida is relatively low compared to other states. Here’s a roundup of the costs we’ve discussed so far to register an LLC in Florida:

- Business Name Reservation filing fee: $25

- Articles of Organization filing fee – $125

- Annual Statement of Information filing fee – $138.75 filing fee

Does Collective Help with Starting an LLC in Florida?

You now know the steps for how to start an LLC in Florida! But if all those lists and paperwork sound overwhelming, consider letting Collective do the heavy lifting for you. We offer a smarter, more affordable way to get your LLC set up and running. We take care of your LLC formation, monthly bookkeeping, accounting, taxes, and more.

Start your LLC with Collective and see how much you can save.