Sign up before June 30th for thousands in savings

Get clean books and a clear financial picture

Keeping your books up to date monthly gives you reliable numbers key to sound financial decisions.

Drive business growth with financial reports

Monthly financial reports, directly to your inbox, give valuable insights to help you scale your business.

Spend more time on your passion → Turn your time into money

When you’re a business-of-one, your time is money. So outsource what you can – and leave your bookkeeping to the experts.

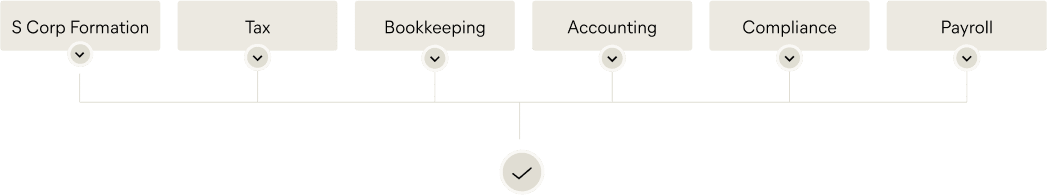

It’s everything you need in one solution

$10,000

average member savings*

Take the next step

Monthly

$349

Yearly

$296

per month

Join thousands of self-employed people who’ve made the switch

I wouldn’t have gotten my business up and running so fast if it weren’t for Collective. Now I can jump in and do what I do without worrying. I am at a higher level. It’s great to feel and be so legit and my clients see this too.

Collective gives me peace of mind. I love having experts available to me when I have questions. I feel more confident that I’m doing things right, thanks to the amazing people at Collective.

Collective helped me with my taxes, bookkeeping and S Corp. I now have my own team of experts answering my questions and guiding me for success. It has been great, I wish I had done it sooner!

Frequently Asked Questions

What are the monthly services I’ll receive as a Collective member?

We’ll do your bookkeeping each month including putting your expenses in the right categories and comparing your bank and credit card accounts. You’ll also receive monthly financial reports, so you have reliable numbers to empower your decision making.

What’s the difference between Collective and a CPA?

CPAs can get quite expensive. And they usually either charge extra for things like bookkeeping. Or you have to go find someone else to handle that part. Now you have two separate services that are scattered. With Collective, we handle the LLC formation, S Corp election, payroll, bookkeeping, financial reports, quarterly tax estimates and compliance all in one solution.

What’s not included in the membership price?

The price doesn’t include third-party fees (such as fees and taxes charged by your city, state or the federal government), individual federal and state tax return preparation and filing, business license filing fees and other license fees, which vary by city.

Does Collective have a setup fee?

Yes, there is a one time Onboarding fee of $199. This fee goes toward ensuring that your business is setup correctly, registered with the appropriate agencies, and in compliance with payroll requirements. This fee also covers catching up and cleaning up your year to date bookkeeping, regardless of the number of transactions.

What’s stopping me from doing my own bookkeeping?

Honestly? Absolutely nothing! Some people do their own bookkeeping. But if it’s not done right, you could miss out on deductions and end up paying more in taxes. It’s also something that should be done regularly – and can take time you don’t have to spare.

What’s the difference between Collective and a bookkeeper?

Your bookkeeper will help you keep your books clean. But anything else you need on the tax and financial side will either cost extra – or you’ll hire someone else to handle it. Things like compliance reminders, taxes, quarterly tax estimates, regular communication and tax education. You won’t get that with a bookkeeper. Leaving you to spend more time figuring some of that stuff out on your own. No thanks!

What makes Collective a great fit for solopreneurs?

Our members have elected to be taxed as an S Corp. It’s a great way to save on your taxes! In fact, they save an average of $10k*. But you typically won’t start to see those savings until you’re making $60k or more per year.

* Based on the average 2022 tax savings of active Collective users with an S Corp tax election for the 2022 tax year